The future of PON at the edge

Today’s existing networks were designed, built, and operated by type of user and service, leading to multiple networks and costly maintenance and upgrades. This approach is not sustainable as bandwidth demand, cloud-based applications with strict latency requirements, and QoE expectations continue to grow.

CSPs (Communication Service Providers) are seeking unified or converged solutions that enable fewer pieces of equipment and software to support multiple applications and user types. Numerous CSPs have restructured their organizations to support convergence. In parallel, Ciena is enabling CSPs to bring PON access into the edge and metro, thereby eliminating discrete PON equipment and software.

Ciena’s Jurgen Hatheier, CTO for EMEA and Vice President of Strategic Sales, and Wayne Hickey, Advisor for Product Marketing, recently joined me in a live panel session to discuss PON’s role in the unification of access and metro networks.

The Problem

Networks were designed, built, and operated according to subscriber type and service, such as broadband to the home for residential subscribers, or Active Ethernet over dedicated fiber for enterprises, or microwave for xHaul transport. CSPs are struggling to maintain and upgrade multiple networks as they face ever-increasing broadband demand from all types of subscribers. In addition, they must support expanding applications and particularly latency-sensitive cloud-based applications. The lines between types of users are blurring as more people work and study from home. Furthermore, CSPs must lower time-to-market for new applications as they face continuing competition from OTT providers.

According to an Omdia survey, 5G xHaul transport costs are a major concern to operators. Omdia forecasts that the outdoor small cell backhaul equipment market will approach $1.5bn in 2024, compared to less than $600m in 2019.

Convergence is key to solving the problem

CSPs are seeking unified solutions where networking equipment and software can support multiple types of subscribers and applications. This convergence leads to fewer pieces of equipment, thereby easing upgrades, lowering operational costs, and simplifying end-to-end management across traffic, application, and subscriber types.

Similarly, numerous CSPs have reorganized themselves, eliminating departments based on subscriber type. For example, many brought together their engineering experts to find solutions that can meet future bandwidth demand, whether created by residential, business, or xHaul transport subscribers and applications. Some CSPs are unifying their access and metro resources, providing more efficient and timely support for edge-based applications.

PON is enabling convergence and edge-based applications

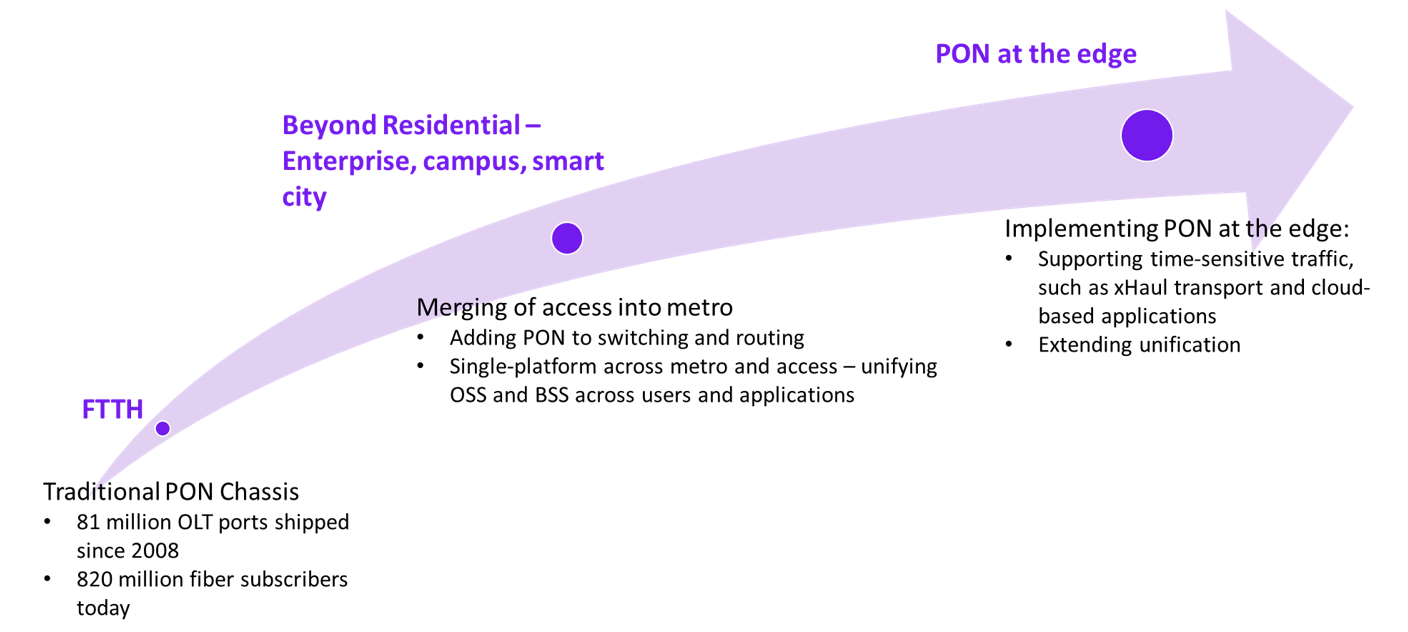

PON is a well-established technology for supporting FTTH with its fiber and energy-efficient, passive point-to-multipoint topology. Recently, PON’s role has extended beyond residential, supporting enterprises, campuses, and smart city applications, as shown in Figure 1. Today, PON is being implemented at the edge, to support time-sensitive traffic such as cloud-based applications and x-Haul transport.

Figure 1: PON has a leading role in convergence (Source: Omdia)

Convergence saves money and enables CSPs to generate revenue opportunities. According to an Omdia survey, 5G xHaul transport costs are a major concern to operators. Omdia forecasts that the outdoor small cell backhaul equipment market will approach $1.5bn in 2024, compared to less than $600m in 2019. PON becomes a tool in the 5G small cell xHaul transport toolbox, supporting the topology of numerous small cells within a small geographic area.

While converged networks save costs, they also enable new services. PON supports time-sensitive services, such as guaranteeing “meantime to the cloud.” Network slices can be offered to subscribers based on bandwidth and latency requirements, with tariffs reflecting the service guarantees. Global cloud-managed networking revenues are forecast to grow at a 20% CAGR, reaching $7.2bn in 2025. Cloud gaming is gaining momentum, finally, and fiber-based broadband is a key catalyst, enabling differentiation on performance, such as low-latency.

Bottom line, convergence flattens the network to the cloud, eliminating complexities while providing flexibility. PON is part of the convergence solution with capabilities to support 10G symmetrical and beyond, along with timing functions and PAYG (pay as you grow) flexibility.

Bottom line, convergence flattens the network to the cloud, eliminating complexities while providing flexibility. PON is part of the convergence solution with capabilities to support 10G symmetrical and beyond, along with timing functions and PAYG (pay as you grow) flexibility.

Vendors are providing PON solutions that support convergence

Ciena developed a pluggable-PON solution, enabling the addition of PON to existing switching, routing, and access aggregation equipment; thereby converging access with metro, using the same management software. In addition, Ciena’s solution can be implemented as a hardened router on a pole to support time-sensitive, edge-based traffic.

As CSPs transform to meet future networking requirements, they are seeking unification of network assets and software, along with scalable and flexible solutions. They need to be able to grow network capacity as needed, using both Active Ethernet and PON, to meet subscriber and application requirements. Solutions must be designed where networks become the platform for traffic policies, encompassing multiple underlying technologies. PON offers a seamless upgrade path to 25G PON, 50G PON, and beyond. Today’s PON supports strict timing requirements, meeting latency requirements for xHaul transport and time-sensitive cloud-based applications.

Omdia’s forecast reflects PON’s support of convergence

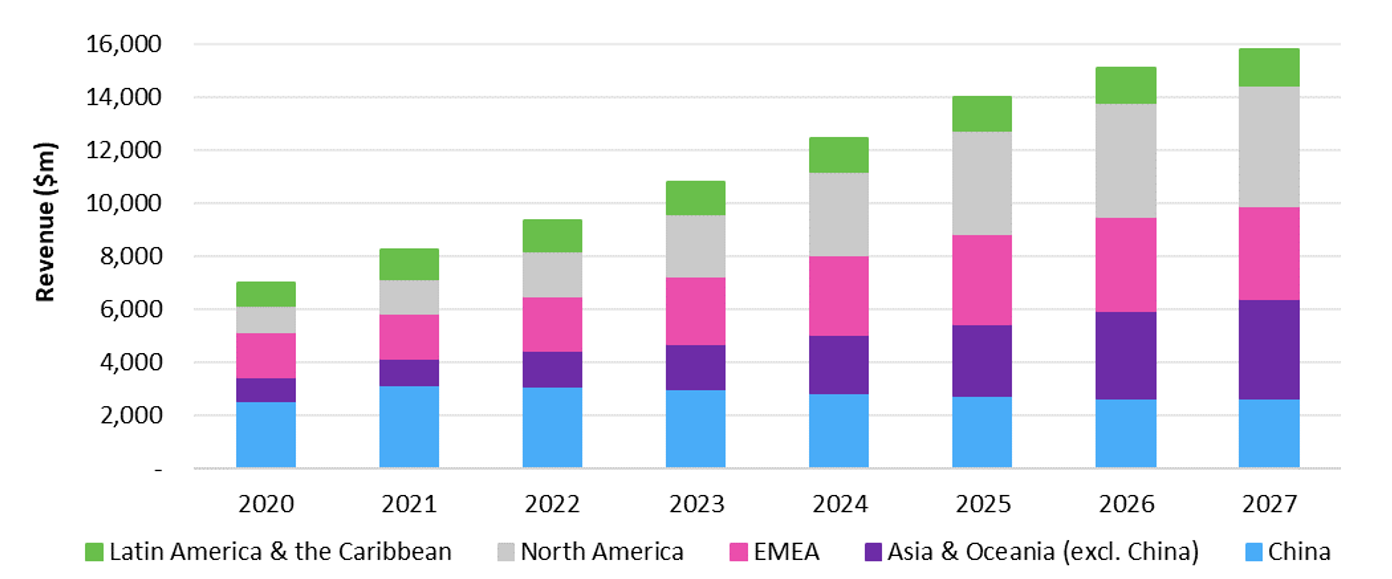

Figure 2: Omdia PON Equipment Forecast through 2027 – Revenues by Region (Source: Omdia)

The PON equipment forecast reflects its strong adoption as CSPs use this fiber, space, and energy-efficient technology to support convergence across the network for different types of subscribers and applications. In addition, PON’s timing capabilities support time-sensitive xHaul transport and cloud-based applications. As shown in Figure 2 above, Omdia’s February 2022 forecast shows a 12.3% CAGR from 2020 to 2027, with the PON equipment revenue forecast reaching $15.7bn in 2027.