It’s been two years since our last research study on the role of Segment Routing (SR) in networks. What has changed? What’s remained the same? Where do global operators' preferences lie now? ACG Research surveyed service provider executives about that and more. Ciena’s Ivana Lemos details the findings.

Can you believe it’s been two years since we first began our global research on the role of Segment Routing (SR) in networks? At that time, SR-MPLS was celebrating its 10-year anniversary, SRv6 was the newer kid on the block, and the burning questions we asked were “why SRv6,” “why not SR-MPLS?” and vice versa.

SRv6 upswings took center stage in many of the 2022 survey results’ insights. For example, an impressive 20% of respondents had plans to adopt SRv6. But now, two years later, where does the proposed adoption of SRv6 stand? You may be surprised by the results and shift.

Recent years have shown SRv6 may not have been the only v6 game in SR town. Many customers have wondered if SR-MPLSv6 could be 'a more natural IPv6 alternative' within their networks. To investigate this further, this year’s survey marks our first detailed look at the SR-MPLSv6 picture.

So, with the new game board set—featuring SR-MPLSv4, SRv6, and SR-MPLSv6—where do global operators' preferences lie?

Without further ado, here are our top findings from 2024.

SR plans hold steady, even as preferences shift

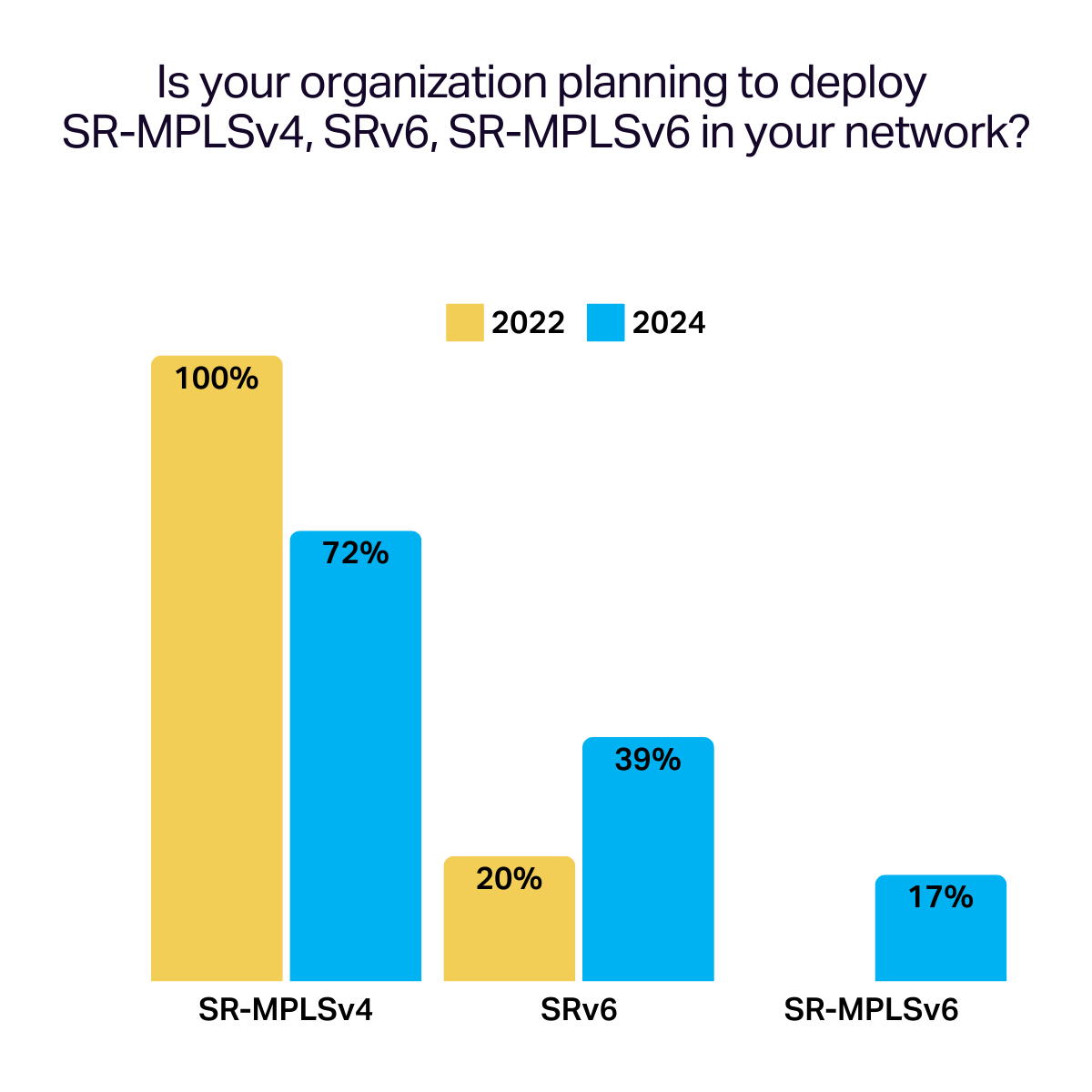

After a near total SR-MPLSv4 supremacy in 2022, we are now seeing a shift in which technologies are being considered in respondents’ current plans. While SR-MPLSv4 still holds preference with 72% of respondents, the newer v6 options saw an uptick in operators' consideration (Figure 1).

Figure 1: SR Plans

But what do these 'plans' really mean? Is support for these technologies aligning with operators’ wallet share? Here's a more granular view.

SRv6 deployments have started; trials have taken off

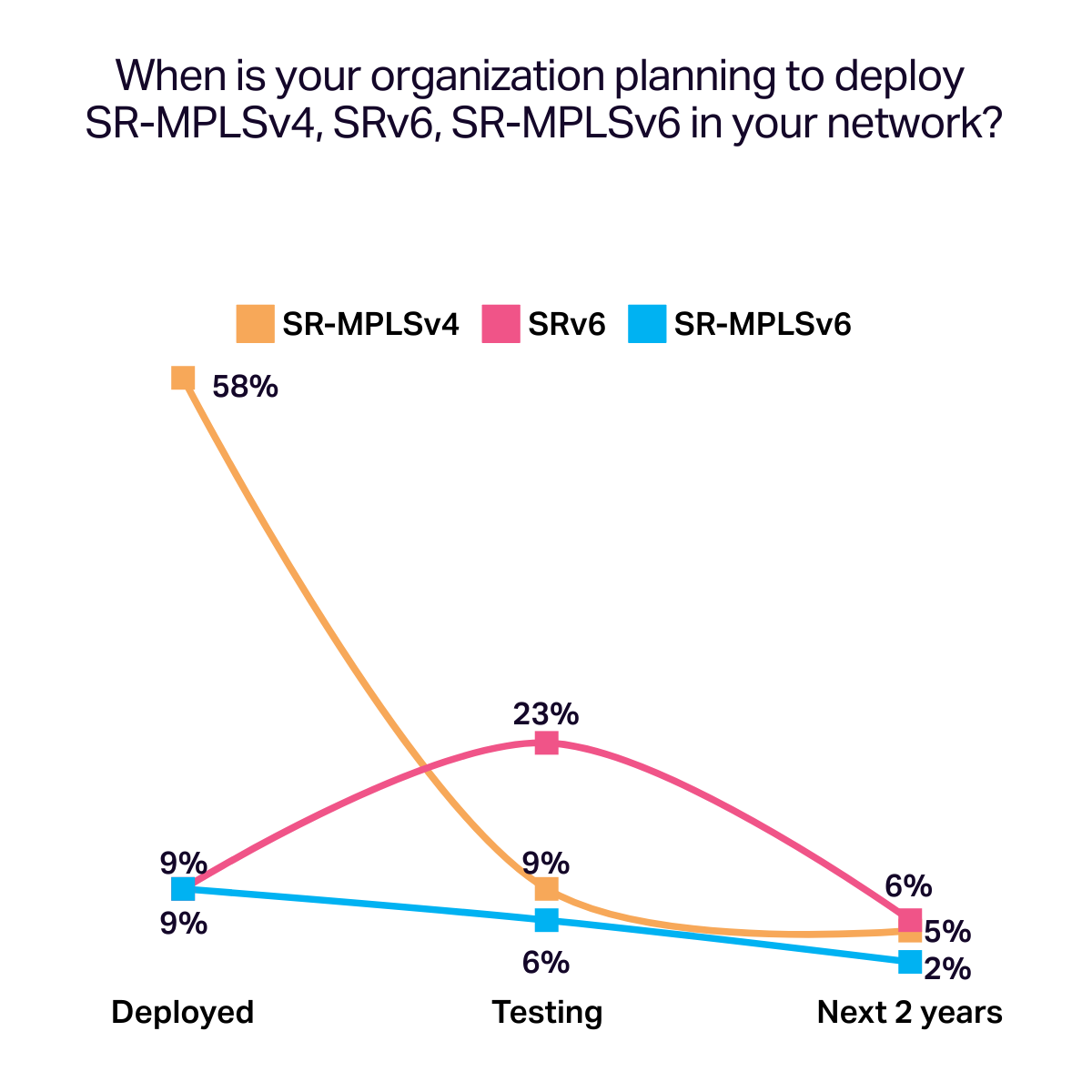

When asked about the adoption lifecycle of these technologies, respondents' decision-making varies (Figure 2).

Figure 2: Adoption lifecycle among those who have SR plans

It’s no surprise that SR-MPLSv4 leads with firm deployment commitments, but notably, there is a high degree of enthusiasm for SR-MPLSv6, which we as an industry will surely keep watching.

Perhaps more intriguing is the softening of the SRv6 curve. Despite a relative uptick in SRv6 plans among respondents (Figure 1), with 39% indicating deployment plans—up from 20% in 2022—only 9% have actually deployed it. Still, expectations for SRv6 impact remain high, with 23% currently trialing the technology.

The question then becomes: What could be holding back SRv6 deployments? Our next trend offers additional insights.

SRv6 compressed leads, while multiple formats are still a concern

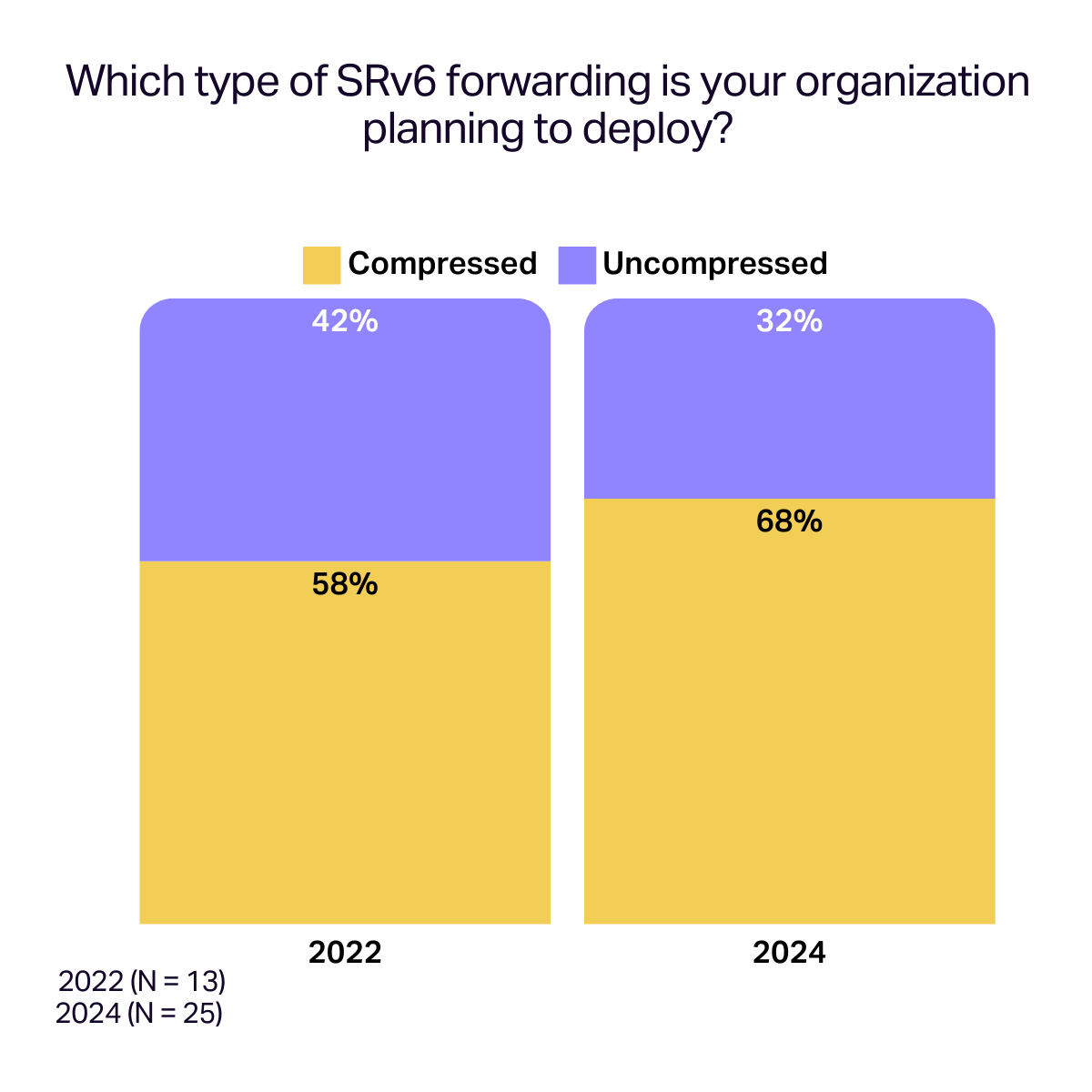

Compressed Segment Identifier (SID) remains the favored design choice for SRv6, with respondent preference rising to 68% from 58% (Figure 3).

Figure 3: SRv6 Compressed vs. Uncompressed SID

While compressed SID —and notably Micro-SID (uSID)— is clearly gaining supporters, this too, is a gradual evolution. Adoption does not guarantee SID interoperability, and both are the measuring stick for success.

What stood out in the in-depth interviews is that a fair share of respondents are concerned about the multiple SRv6 SIDs available. Anecdotally, some are in 'wait-and-see' mode, holding out for the industry to align on a common format.

But despite the perceived complexity, progress is steady. It is worth noting that the latest (and largest) multi-vendor SRv6 interoperability test, which Ciena participated in, took place this year at EANTC and tested SRv6 interoperability across multiple vendors.

Traffic engineering is maturing

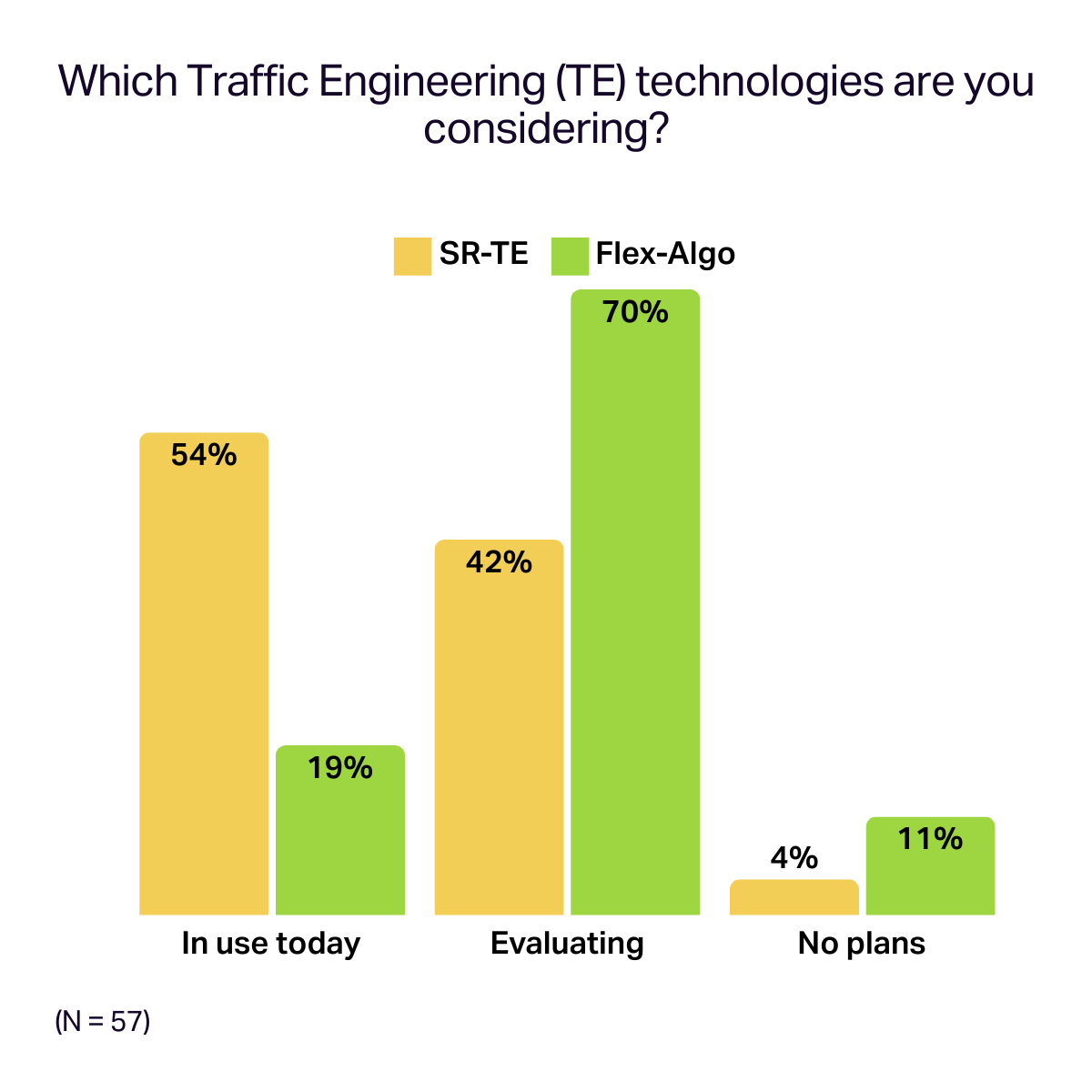

This year's findings reassured the momentum of traffic engineering (TE) spotted in the first survey. To put it in perspective, more than half of respondents are using SR-TE today, and there's a strong interest in Flex-Algo, with a 70% evaluation rate (Figure 4).

Figure 4: Trends in traffic engineering preferences

Ultimately, respondents believe more TE applications will follow suit, which leads us to our last insight.

Controller adoption is on the rise

SR relies on SDN architecture, so controllers are a big part of the equation.

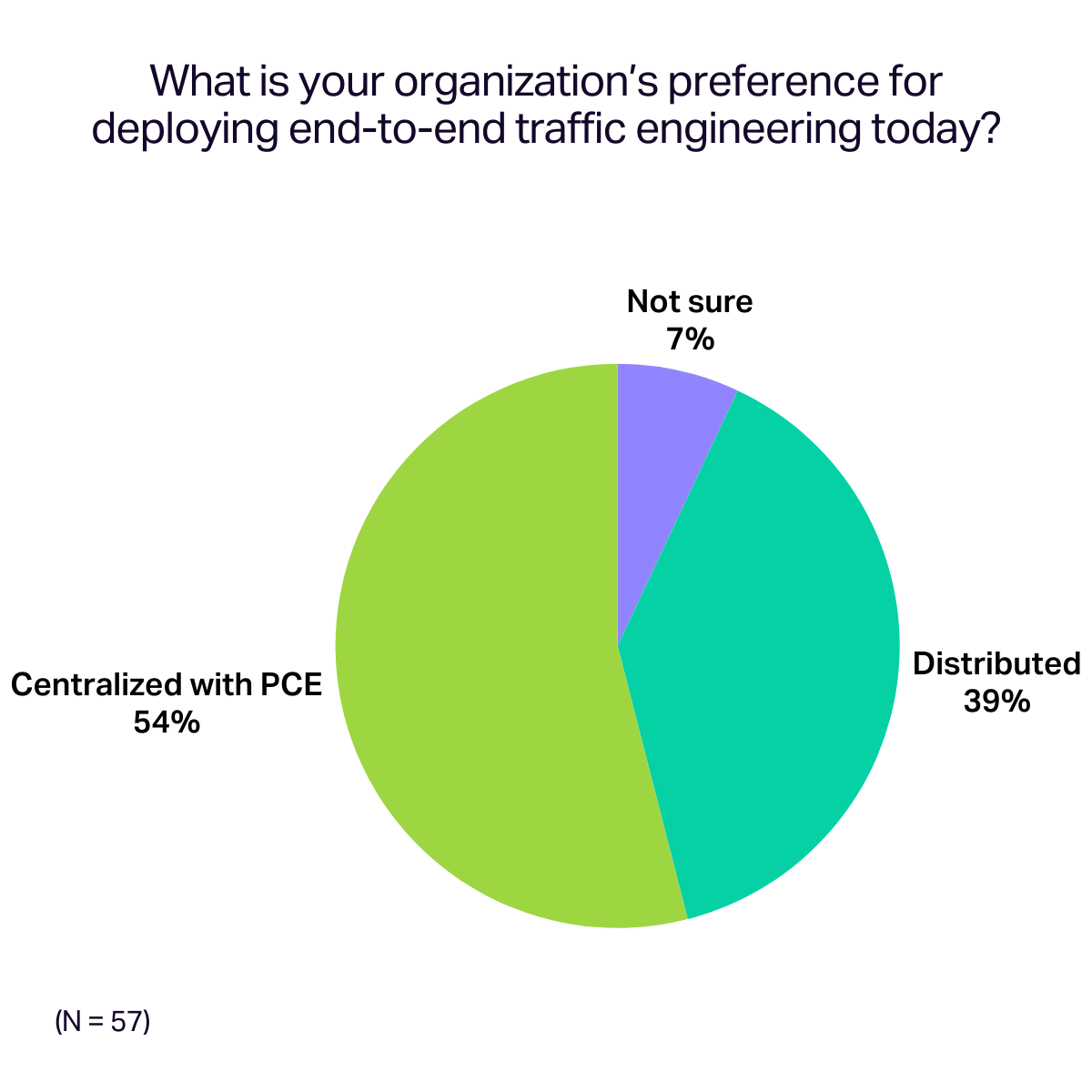

To that point, we asked respondents about potential controller use cases: namely, end-to-end TE. Among respondents, most (54%) cite centralization with the Path Computation Element (PCE) as their preferred TE strategy (Figure 5).

Figure 5: End-to-end traffic engineering preferences

As the figures show, controllers are becoming the sticking point not only for TE but also for many other powerful network programming applications. To learn more, check out Ciena’s Navigator NCS multi-vendor SDN interoperability results at the 2024 EANTC testing.

Ciena and ACG Research: Our take on the survey findings

In light of these findings, we approached Jahanzeb Baqai, Ciena’s Product Line Manager, to provide insights on the interplay between SR-MPLSv4, SRv6, and SR-MPLSv6 dynamics. Baqai confirmed observing similar trends in the field, with an increase in the number of SRv6 trials and opportunities.

According to Baqai, customers are increasingly interested in SRv6 interoperability and flexible design options in these engagements. Ciena has been proactive in addressing these needs, supporting both compressed uSID and uncompressed SID options for SRv6 across our software and hardware portfolio.

Furthermore, Baqai highlighted that SR is revitalizing Traffic Engineering (TE) with the emergence of new use cases. And controllers play a pivotal role in turning these deployments into reality.

Regarding SR-MPLSv6, Baqai noted that curiosity is growing, but the actual deployment outcomes are still under evaluation.

For more, check out ACG's Ray Mota and Ciena's Jahanzeb Baqai discuss these and other survey findings here.

Lessons learned and SR lasting impact

The results of this year’s survey show the expansion of the SR technology’s use since we began tracking it two years ago. The pace of innovation and the wave of industry investment have been remarkable. And we’re already seeing how leading operators are capturing business value from these often-dazzling techy capabilities, as illustrated by the TE use cases just described.

Still, SR is a rich area, and I hope this blog has sparked your curiosity. For a deeper dive into the survey data, including other interesting insights, hit play to watch this presentation – you'll find it insightful!